Article Source : Click Here

Nerida Conisbee – Chief Economist

Three distinct interest rate cutting cycles since 2015 show how Australia’s housing affordability crisis has fundamentally changed which suburbs benefit most from lower rates.

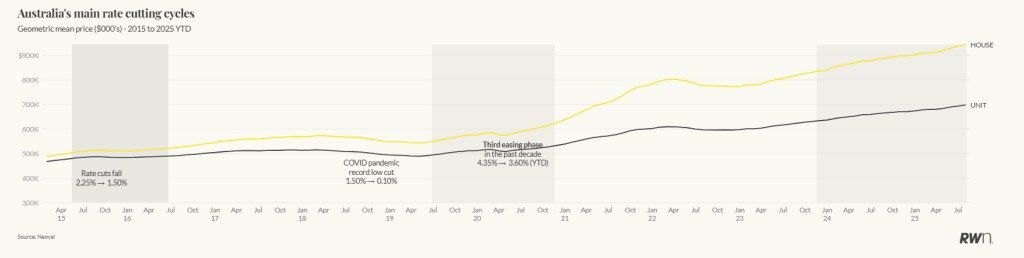

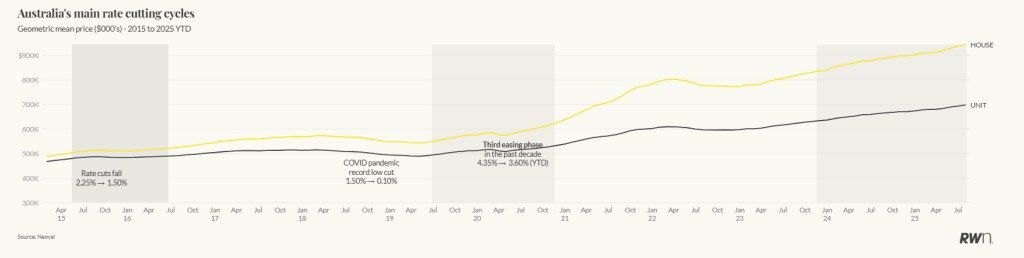

Australia has experienced three major interest rate cutting cycles since 2015, each delivering vastly different impacts across the housing market. The Reserve Bank’s gradual easing from May 2015 to May 2016 saw rates fall from 2.25 per cent to 1.50 per cent, followed by the aggressive cuts from June 2019 through the COVID emergency period that took rates from 1.50 per cent to a historic low of 0.10 per cent by late 2020. The current cutting cycle, beginning in 2024 from multi-year highs above 4 per cent, represents the third distinct easing phase in a decade. Analysis of suburb-level data reveals that each cycle has benefited entirely different segments of the market, with the most responsive areas shifting dramatically based on the economic context and buyer demographics of each period.

Source: Neoval

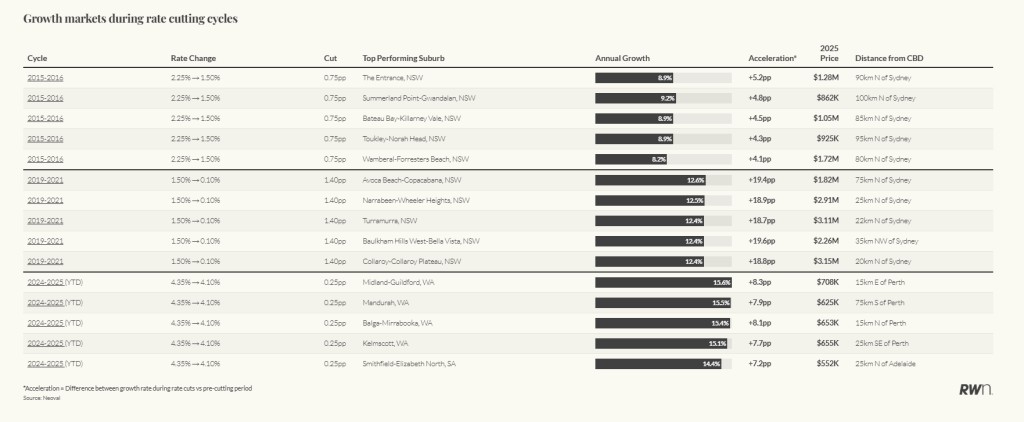

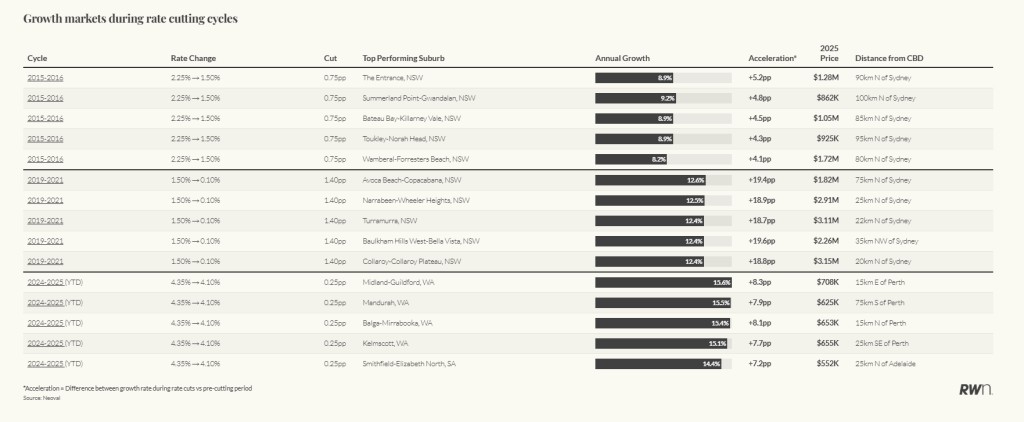

This analysis uses annual suburb-level price data from Neoval covering 1,339 areas across Australian capital cities from 2015 to 2025. Rate cut sensitivity is measured by comparing annual price growth during cutting periods against pre-cutting baseline growth, with “acceleration” calculated as the difference between these growth rates. For example, if a suburb grew 5 per cent in 2018-2019 then 12 per cent in 2019-2020 during the rate cuts, the acceleration is 7 percentage points. The three cycles analysed are: 2015-2016 growth (first cycle), 2019-2020 and 2020-2021 growth (second cycle combining pre-COVID and emergency cuts), and 2024-2025 growth (current cycle). Suburbs showing consistent positive acceleration across multiple cycles are identified as reliably rate-sensitive, whilst those with the highest growth during cutting periods demonstrate maximum sensitivity to monetary easing.

Source: Neoval

2015-2016 Cycle: The shift to affordable regional coastal markets begins

The first cutting cycle from May 2015 to May 2016 saw the Reserve Bank reduce rates by 0.75 percentage points in response to moderating economic growth and subdued inflation. This gradual easing primarily benefited coastal lifestyle markets within commuting distance of major cities, with NSW’s Central Coast emerging as the standout performer. Areas such as Avoca Beach-Copacabana (8.0 per cent growth), Wamberal-Forresters Beach (8.2 per cent), and The Entrance (8.9 per cent) led the market response. These suburbs, typically priced between $800,000 and $1.2 million at the time, attracted people looking for coastal lifestyles with commuting distance to Sydney. While COVID led to a shift to regional areas, the reality is that it had already started quite some time earlier.

2019-2021 Cycle: Premium Sydney suburbs dominate the rate cut response

The most aggressive cutting cycle began in June 2019, then accelerated dramatically during the COVID emergency period as rates plunged from 1.50 per cent to 0.10 per cent. These unprecedented rate cuts led to the strongest responses in Sydney’s premium suburbs, with areas like Turramurra (12.4 per cent growth in 2019-2020), Castle Hill precincts (over 12 per cent), and Northern Beaches locations including Collaroy-Collaroy Plateau and Freshwater-Brookvale all posting double-digit gains. The biggest acceleration occurred in Castle Hill areas, where suburbs like Baulkham Hills West-Bella Vista swung from -7.2 per cent growth to +12.4 per cent, representing a 19.6 percentage point acceleration. These were predominantly million-dollar-plus markets, reflecting how the combination of ultra-low rates and fiscal stimulus created a pronounced “wealth effect” favouring established property owners looking to upgrade or invest in premium locations

2024-2025 Cycle: Affordable outer suburbs emerge as the new rate cut champions

The current cutting cycle, beginning from the highest rates in over a decade, has fundamentally reversed previous patterns by most benefiting affordable, outer suburban areas. Perth has dominated this cycle, with areas like Midland-Guildford (15.6 per cent growth), Mandurah (15.5 per cent), and Balga-Mirrabooka (15.4 per cent) leading national growth rates. Adelaide’s outer suburbs have also responded strongly, with Smithfield-Elizabeth North posting 14.4 per cent growth. These areas, typically priced between $550,000 and $750,000, represent traditional first home buyer territories where borrowing capacity improvements from rate cuts have the greatest impact. This marks a dramatic shift from previous cycles, with the most rate-sensitive areas now concentrated among affordable markets rather than lifestyle or premium segments, reflecting how Australia’s housing affordability crisis has fundamentally changed who benefits most from monetary easing

The evolution of rate cut beneficiaries across three distinct cycles reveals fundamental shifts in Australia’s housing market dynamics. From emerging coastal lifestyle markets in 2015-2016, to premium Sydney suburbs during the COVID emergency, to affordable outer areas today, each cycle is different. The Central Coast’s consistent performance across all cycles suggests certain markets maintain enduring rate sensitivity, but the dramatic swing from million-dollar suburbs to sub-$750,000 areas demonstrates how affordability constraints now dictate market responses. As further rate cuts are anticipated, the current pattern suggests Australia’s monetary policy increasingly serves first home buyers, a profound shift from what happened during COVID.

Article Source : Click Here