Price Divergence Continues

Nerida Conisbee

Ray White Group

Chief Economist

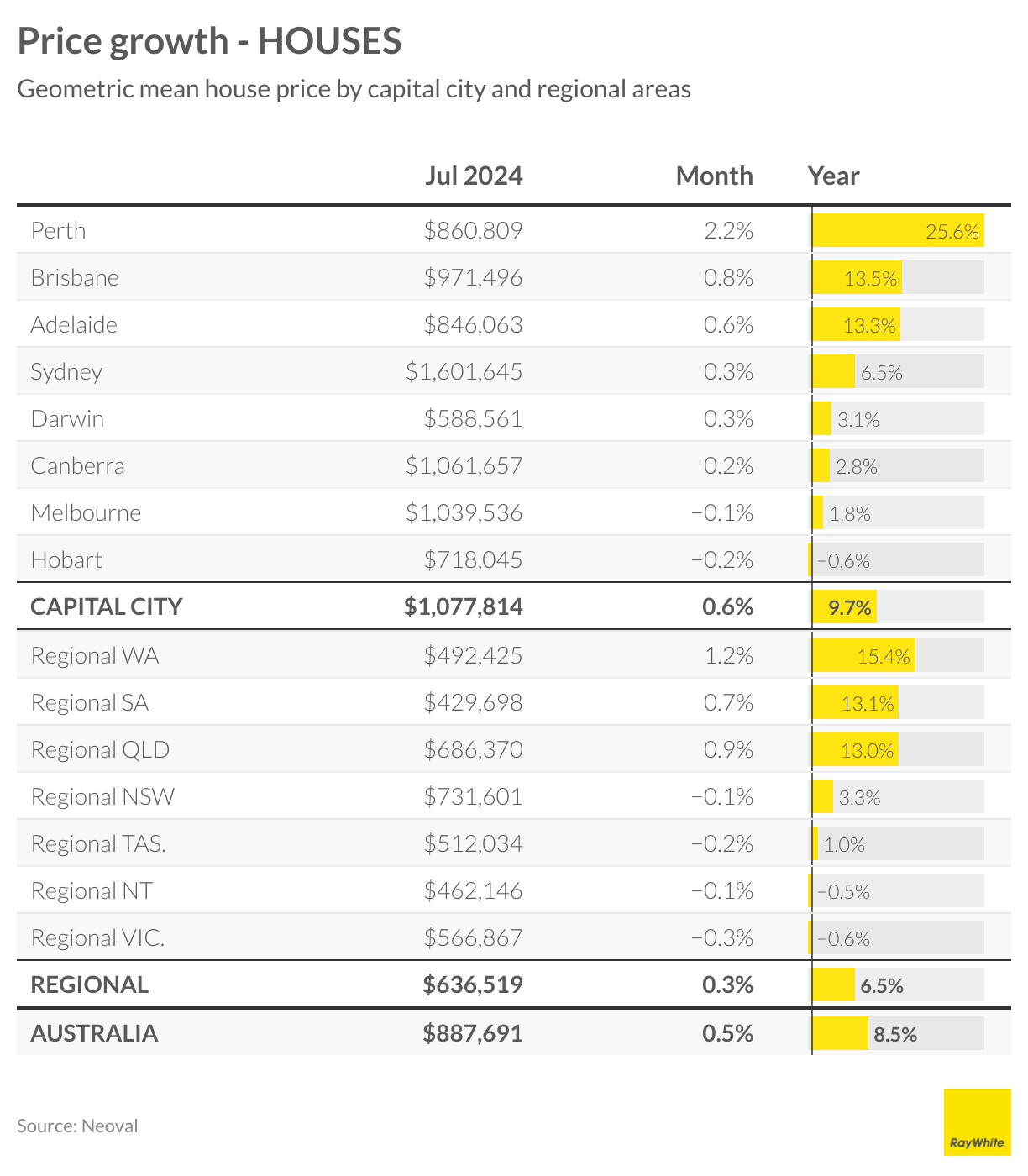

Perth, Brisbane and Adelaide continue their strong run, all exceeding 13 per cent price growth over the past 12 months. Perth remains red hot, recording an increase of 25.6 per cent over the past 12 months, with no signs of slowing at this point.

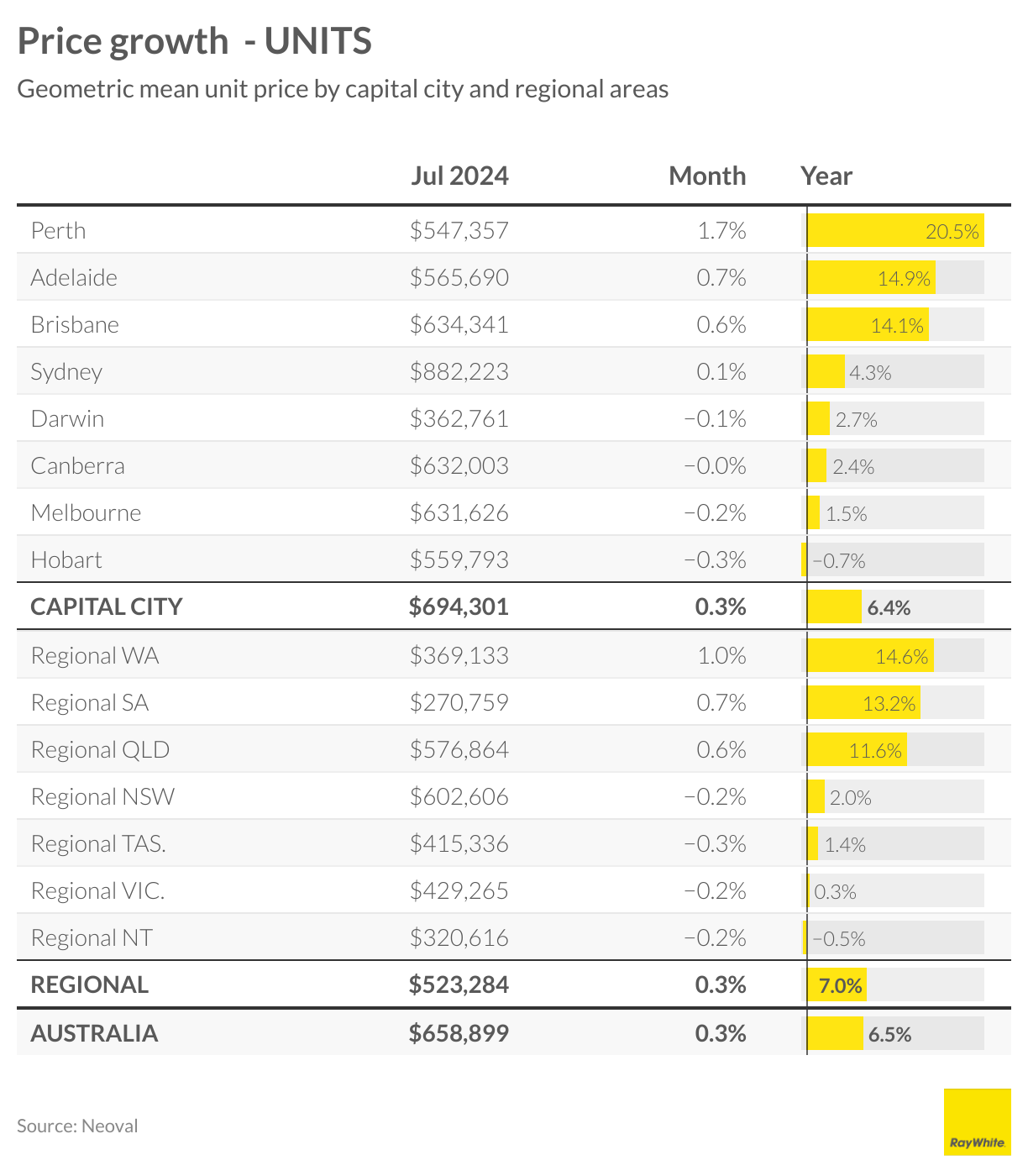

In direct contrast, Melbourne and Hobart are seeing weak conditions. Hobart is now recording house price declines over the past 12 months, while Melbourne is increasing only marginally at 1.8 per cent. A similar trend is being observed in the unit market for all these cities.

There are likely a number of drivers for the Melbourne decline. Victoria is possibly in recession and additional taxes on property owners to pay back state debt has made investing in property less attractive. We are now seeing an increase in properties coming to market but days on market has also increased dramatically. Melbourne’s days on market is now at its highest level since December 2020 while Hobart is at its highest since 2015. In comparison, Perth is currently the lowest at nine days.

The market in the middle is Sydney. While not as strong as the smaller capital cities, it is still experiencing relative strength. In all capital cities, the most expensive suburbs are still seeing strength. House prices in Rose Bay increased by $200,000 over the past 12 months, the largest increase of all suburbs. Melbourne price growth is weak overall but Brighton prices have increased by in excess of $110,000 over the past year.

Brisbane unit prices are still increasing faster than houses year-on-year, likely driven by high construction costs in this state, as well as fast population growth. Brisbane units are getting expensive, and now exceed Melbourne unit prices.

The outlook for the rest of the year looks set to continue. At this point, it is likely that rates will not be cut until the start of 2025 and the economy is continuing to slow. In addition, migration levels will also be lower this year compared to last. However, in contrast high construction costs will keep the cost of building a new home high which will continue to drive people to buy established homes and limit housing supply.

Download charts and image of Nerida Conisbee here.

Media contacts

Nerida Conisbee

Ray White Group

Chief Economist

nconisbee@raywhite.com

0439 395 102

Shannon Cook

Ray White Group

Senior media advisor

media@raywhite.com

0437 593 050

Article Source: Click Here