Article Source : Click Here

Nerida Conisbee – Chief Economist

Australia’s housing market experienced a pronounced deceleration in July following the Reserve Bank’s surprise rate hold, with national house price growth remaining flat, a sharp decline from June’s robust 1.0 per cent pace. However, with a widely anticipated 0.25 per cent rate cut expected in August, followed by two additional cuts before year’s end, this pause appears temporary as markets position themselves for renewed acceleration.

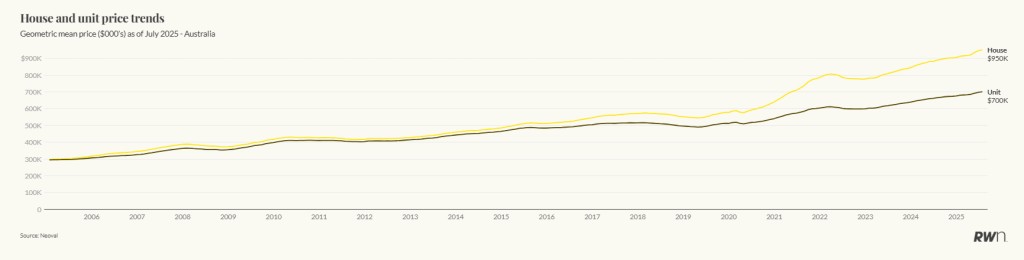

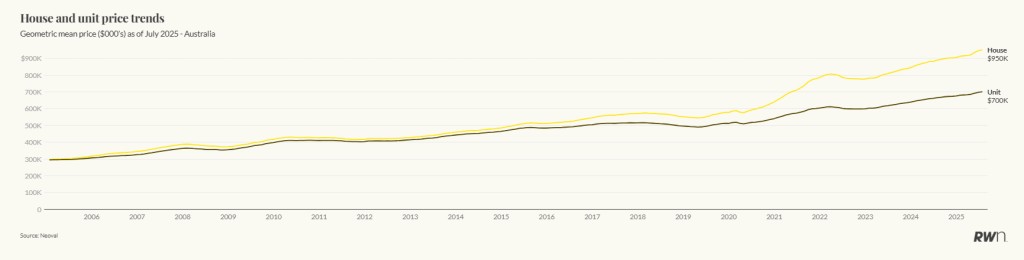

National house prices reached $950,000 in July 2025, whilst unit prices climbed to $700,000, representing annual growth rates of 6.4 per cent and 5.2 per cent respectively. The bigger markets showed mixed results, with Sydney houses moderating from 0.5 per cent to 0.2 per cent monthly growth and Melbourne slipping into negative territory at -0.1 per cent. Brisbane experienced the most pronounced cooling, falling from 1.1 per cent to 0.2 per cent monthly growth. Even Perth, the nation’s fastest-growing market, moderated from 1.3 per cent to 0.6 per cent monthly growth, though it maintained its leadership position.

Source : Neoval

Source : Neoval

The standout story was the remarkable resilience of unit markets, which maintained solid 0.3 per cent monthly growth. Sydney units defied all trends by accelerating from 0.2 per cent to 0.4 per cent monthly growth – the only market segment nationally to improve during the rate hold period.

Source: Neoval

This unit resilience reflects chronic undersupply in the apartment sector and declining housing affordability driving buyers towards smaller homes. Perth units maintained exceptional 1.0 per cent monthly growth, whilst Brisbane units at 0.6 per cent significantly outperformed Brisbane houses at just 0.2 per cent.

Once the expected rate cuts commence in August, housing markets should return to the acceleration trajectory witnessed earlier in 2025. The combination of lower borrowing costs and pent-up demand from July’s pause could deliver a particularly strong rebound. If the anticipated cutting cycle delivers three reductions by year’s end, national house price growth could accelerate beyond the current 6.4 per cent annual rate, potentially reaching double-digit territory as witnessed in Perth’s 11.3 per cent annual performance.

Unit markets, having demonstrated resilience during the hold period, appear particularly well-positioned to benefit from renewed easing. The structural tailwinds of supply constraints and affordability-driven demand should amplify the impact of lower rates, potentially pushing annual unit growth well above the current 5.2 per cent national rate.

Article Source : Click Here