Nerida Conisbee

Ray White Group

Chief Economist

Many of us love homes with great views and access to nature. Beachfront properties, riverside homes, and bush retreats are always in demand. But these desirable locations are often the most vulnerable to climate change.

Beaches face rising seas, rivers may flood more often, and bush areas are at risk of wildfires. Despite these growing threats, house prices in many of these areas keep climbing. This report looks at whether homebuyers are considering climate risks, particularly flood risk, when buying in these locations, or if the dream of an ideal lifestyle is making the potential danger and rise in insurance costs worth the cost.

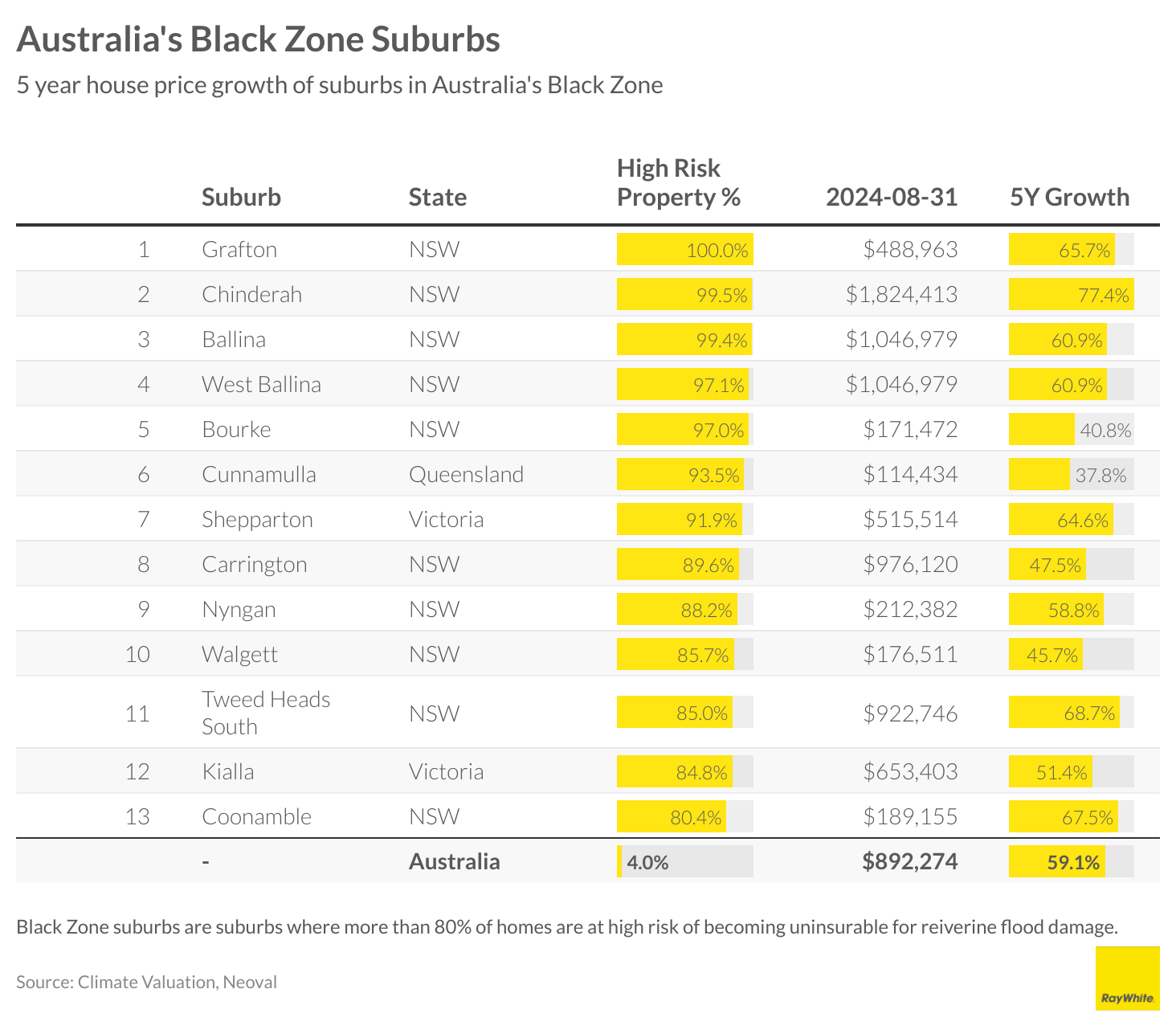

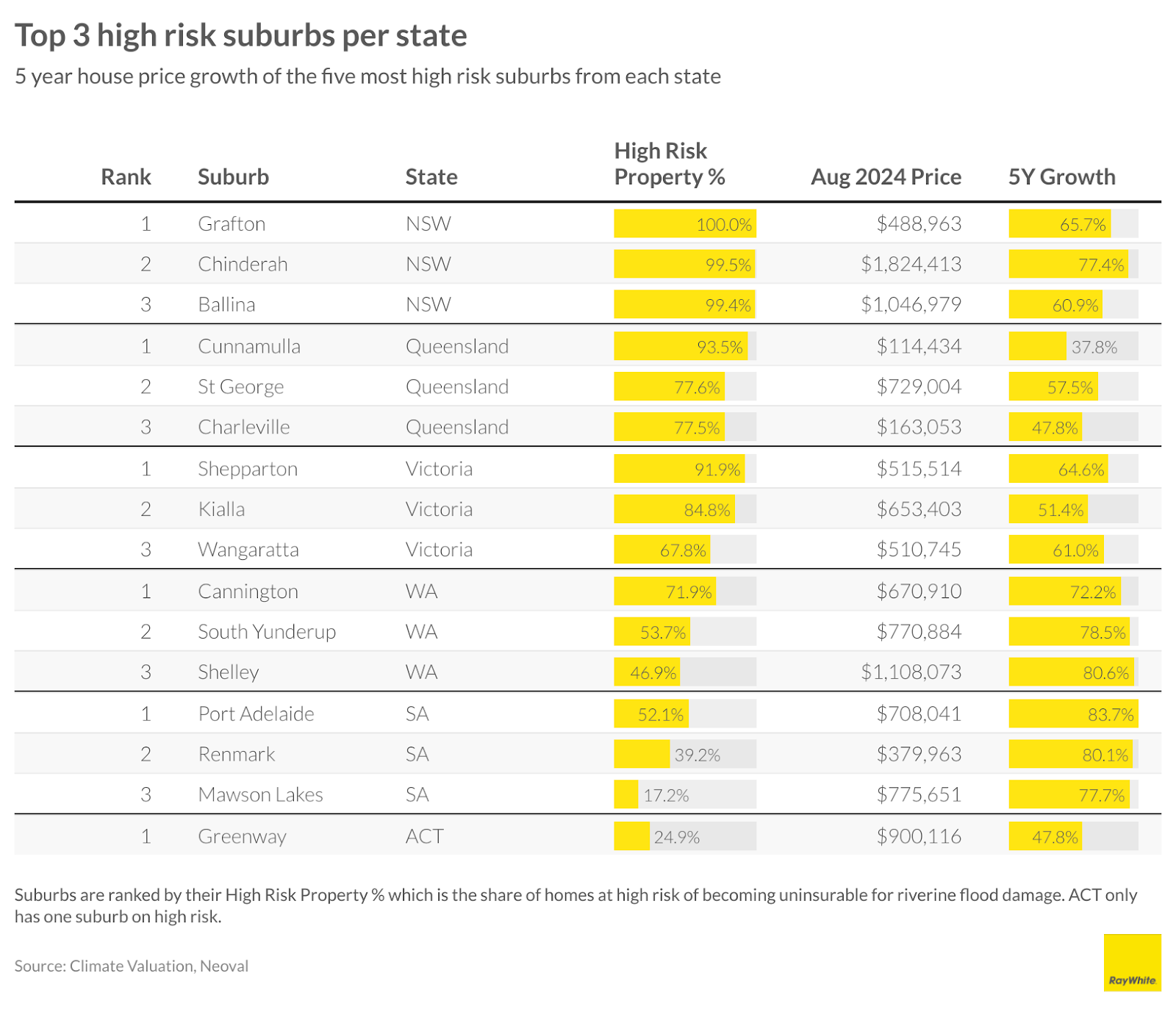

Climate Valuation is a company that provides climate risk analysis to individual property owners. In June 2024, they produced a report looking at suburbs and towns with a high risk of flooding. Across Australia, four per cent of all properties are considered to be high risk, i.e., they carry a high risk of being uninsurable or prohibitively expensive to insure for flooding. Overall, the report found that Queensland had the highest proportion of homes at high risk (5.1 per cent of all homes) with the ACT having the lowest (1.6 per cent).

In this report, we look at whether the risk of being uninsurable for flooding has an impact on home values. In particular, whether the areas most at risk under or over perform relative to the wider market. By doing so, it provides some measure as to whether people are pricing in flood risk, or they are buying in these areas despite the risks.

Overall, it appears that the risk of becoming uninsurable for flooding has a limited impact on demand for property. In total, 13 suburbs are considered to be Black Zone suburbs with more than 80 per cent of properties in these areas at high risk. Of the 13 suburbs, all of them experienced price growth over the past five years, with more than half of them (seven) seeing price growth stronger than the Australian average. Grafton, Chinderah and Ballina, all have more than 99 per cent of properties considered to be high risk but all of these suburbs’ house price growth outperformed the Australian average over the past five years.

At a state level, we see a similar trend with most suburbs at high risk seeing decent price growth. The only state where price growth in high risk suburbs have been well under the state average has been in Queensland. It could either be the isolated nature of two of the suburbs on the list (Cunnamulla and Charleville) or perhaps a number of large scale flooding events in Queensland have made buyers more cautious.

Overall, it appears that climate risk has a limited impact on demand for homes in high risk suburbs. While we only looked at one risk factor (flooding), it is likely we would see a similar trend for other climate linked events such as bushfires. The drive to live near water and close to the bush seems to outweigh the elevated cost of insuring homes in these areas, and the potential danger that wild weather events can create.

Download charts and image of Ms Conisbee here

Media contact

Nerida Conisbee

Ray White Group

Chief Economist

nconisbee@raywhite.com

0439 395 102

Article Source: Click Here